Mongolia’s Bond Market: From Refinancing Cycles to Credit Resilience

Nov 10, 2025

Enkhjin A.

From Fragile Access to Fiscal Credibility

Mongolia’s bond market has evolved dramatically over the past 5 years—from an era of high-yield refinancing challenges to a period of sustained market access, disciplined debt management, and fiscal credibility. Today, Mongolia maintains an active $5.06 billion international bond portfolio, spanning sovereign, quasi-sovereign, and corporate issuers, with 13% of total obligations already redeemed.

Between 2020 and 2025, the sovereign issued a series of benchmark bonds that gradually extended maturities and stabilized funding conditions: Mongol 2026 (Oct 2020), Mongol 2027 & 2031 dual tranches (Jul 2021), Mongol 2028 (Jan 2023), Mongol 2029 (Dec 2023), and Mongol 2030 (Feb 2025). Each new issuance reflected greater investor confidence, improved macro fundamentals, and stronger regulatory underpinnings.

Credit Rating Upgrades: A Stepwise Climb in Credibility

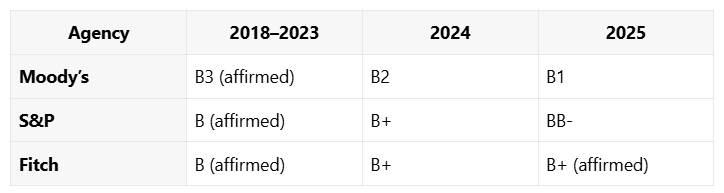

Over the last 2 years, Mongolia has achieved its most significant credit-rating improvement in a decade, underscoring stronger fiscal fundamentals and policy coherence.

All three agencies cite 3 consecutive years of budget surpluses, net government debt falling to ~32 percent of GDP, and effective liability management as the main upgrade catalysts. This fiscal turnaround—backed by the Fiscal Stability Law (FSL) and Debt Management Law (DML)—has lowered interest-servicing costs and lengthened the sovereign maturity profile.

Complementing fiscal strength, real GDP growth of 5.5–5.7 percent in 2025, supported by the Oyu Tolgoi copper mine and expanding gold and rare-earth production, signals a more resilient and diversified economy. Together, these factors explain why S&P raised Mongolia to BB-, Moody’s to B1, and Fitch maintained B+ with Stable outlook—marking Mongolia’s ascent into the upper tier of frontier-market credits.

Inside the Market: Active and Listed Bonds

Mongolia’s international bond market, totaling $5.06 billion, now encompasses a well-defined structure of sovereign, quasi-sovereign, and private sector issuers, each contributing to the country’s deepening capital market maturity.

Sovereign Bonds (2020–2025) — The Government of Mongolia has maintained a consistent issuance strategy, strengthening investor confidence through predictable refinancing and extended maturities. The current sovereign curve includes Mongol 2026, Mongol 2027, Mongol 2028, Mongol 2029, Mongol 2030, and Mongol 2031, collectively forming the benchmark framework for Mongolia’s external debt. These instruments are trading near par, supported by fiscal surpluses, stable reserves, and declining net government debt ratios.

Quasi-Sovereign Bonds (2023–2025) — Institutions such as the Development Bank of Mongolia (DBM), Ulaanbaatar City, and State Bank have emerged as credible quasi-sovereign borrowers. Their bonds — DBM 2028, Ulaanbaatar 2027, and State Bank 2028 — combine sovereign-linked credibility with independent operational mandates. These issues finance strategic priorities including infrastructure, urban redevelopment, and ESG-focused projects, and have seen yields tighten substantially following the sovereign upgrade to B+ (Stable).

Corporate Bonds (2024–2025) — Mongolia’s private sector has regained international traction through diversified issuances such as Golomt Bank 2027, TDB 2027 & 2029, MGMTGE 2027, and MONMIN 2026. These USD-denominated instruments finance business operations, refinancing, and green projects, reflecting stronger governance and improved credit access. Trading primarily over-the-counter, their yields have converged within the 8–9% range, underscoring normalized credit spreads and growing investor comfort with Mongolian corporates.

Regulatory Modernization: Building a Smarter Market

Key policy instruments underpinning this evolution include:

- Fiscal Stability Law (FSL): Caps public debt at 60% of GDP, enforcing fiscal prudence.

- Debt Management Law (DML): Enables sovereign guarantees (100% for DBM and Ulaanbaatar bonds) and generally up to 85% for other eligible entities; guarantee fees, risk assessments, and a debt-guarantee fund are mandated

- Currency Regulation Law: Requires Bank of Mongolia registration for all foreign-currency loans.

- AML/CFT Law (2023 revision): Aligns Mongolia with international transparency standards and FATF compliance.

Collectively, these reforms have enhanced investor protection, improved transparency, and lowered systemic risk.

Conclusion: Toward a Stable, Credible, and Investable Frontier

From 2020 to 2025, Mongolia’s bond market has transitioned from cyclical sovereign refinancing to policy-anchored resilience. Credit upgrades, a diversified issuer base, and improved legal frameworks now define its market identity.

With $1.8 billion maturing in 2027, continued prudence in refinancing and investor engagement will be pivotal. Yet Mongolia’s trajectory is clear: a maturing frontier market with rising credit quality, competitive yields, and a credible commitment to fiscal discipline and transparency—positioning it as one of Asia’s most promising frontier fixed-income stories.

Download the full report: https://capitalmarkets.mn/insight/115

Loading ...