Mongolian-Linked Equities That Led the Market in 2025

Dec 22, 2025

Enkhjin A., Namkhaidorj B.

As the holiday season approaches, it’s a good moment to look back at Mongolia-linked equities listed on global exchanges and reflect on which names delivered the strongest returns for investors in 2025. Until recently, all such listings were concentrated in the mining sector, although this year marked an important milestone with the parent company of Mongolia’s largest NBFI listing on the LSE via a reverse takeover.

That said, returns in 2025 were still largely driven by gold- and copper-focused miners. While these companies operate at different stages of the mining lifecycle, they share a few common traits: all are mining-centric, listed on Canadian exchanges, and highly leveraged to gold and copper prices, with core asset exposure tied to Mongolia.

Taken together, these shared characteristics, alongside better operational execution and a supportive commodity price backdrop, helped sustain strong investor interest throughout the year.

Let's dive in.

I. Top Performers

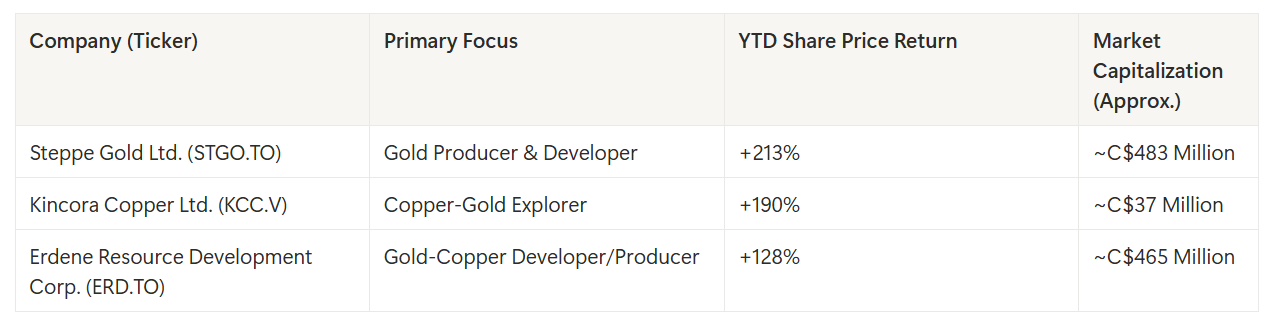

The three companies we reviewed were the top performers in the Mongolia-linked portfolio this year, with strong returns fueled by everything from successful transitions to producer status to exciting, high-impact exploration results.

Common theme:

Even though these companies operate at different stages of the mining lifecycle, they share a common investment story: all are tied to gold and copper price dynamics, have key assets in Mongolia, and have effectively tapped capital markets to fund critical de-risking and growth initiatives.

The standout performance we’ve seen across these names this year comes down to three converging factors: operational de-risking, favorable commodity tailwinds, and strategic access to capital markets.

The Three Pillars of Value Creation

The rise of stock performance of these equities is fundamentally linked to the following three drivers:

- Operational De-risking: The most significant catalyst has been the successful transition of projects from high-risk development phases to consistent production (STGO, ERD). This transition unlocks substantial value by confirming technical viability and signaling the imminent start of cash flow.

- Favorable Commodity Tailwinds: Strong global prices for gold and copper have provided a supportive macro backdrop. Companies that successfully shed hedging contracts (STGO) or commenced production (ERD) directly benefited from higher spot prices, significantly boosting revenue and operating cash flow.

- Strategic Capital Markets Access: Listing on major exchanges (TSX/TSX-V) has provided the necessary capital and liquidity to fund large-scale resource development and exploration programs, a critical factor for long-term growth in the resource sector.

II. Company Spotlight

1. Steppe Gold Ltd. (STGO.TO): The Production Story

Steppe Gold Ltd is a Mongolia-focused precious metals explorer and developer headquartered in Ulaanbaatar, with a vision to build a leading domestic gold platform. The company is advancing its 100%-owned Altan Tsagaan Ovoo (ATO) Gold Project through resource expansion drilling and heap-leach development, while actively exploring its 80%-owned Uudam Khundii Gold Project. Listed on the TSX, Steppe Gold has delivered an impressive +208% YTD return, reflecting the successful transition of its operations into a consistent gold producer.

Performance Drivers: Operational Excellence and Spot Price Exposure

The primary driver of STGO’s re-rating was the sustained operational success at its Boroo operations, coupled with a strategic shift in its sales profile.

- Consistent Production: Following major fleet upgrades in 2025, alongside ongoing maintenance and the recovery of third-quarter operational downtime, the Boroo Gold Mine accelerated the processing of higher-grade ore. As a result, fourth-quarter production is now expected to exceed 23,000 oz, upgraded from prior expected production of 15,000 oz. With the processing of finished goods as of September 30, 2025 completed in October, Q4 gold sales are projected to exceed 30,000 oz, lifting full-year Group production to approximately 70,000 oz.

- Spot Price Leverage: A key catalyst was the expiry of the Boroo Gold forward contract in June 2025, which meant all subsequent production in the second half of 2025 was sold at higher spot prices. This direct exposure to the strong gold market significantly boosted revenue and operating cash flow in Q3 2025, justifying the company’s current market capitalization of approximately C$475 million.

2: Kincora Copper Limited (KCC.V) - The High-Leverage Explorer

Kincora Copper Ltd is a copper-porphyry-focused explorer with its primary growth engine in NSW, Australia, where it controls a district-scale position in the Macquarie Arc and is advancing drilling-led discoveries, including at Trundle. The company also maintains a Mongolia project portfolio, featuring a maiden Mineral Resource and an updated Exploration Target under JORC, though its current focus remains on Australia. Kincora is dual-listed on the ASX and TSX Venture Exchange.

With an estimated +121% return over the past 12 months, Kincora delivered a high-leverage gain. As a pure-play copper-gold explorer, its performance underscores the high-risk, high-reward nature of discovery-focused junior miners, particularly in a strong copper market.

Performance Drivers: Strategic Funding and High-Impact Drilling

KCC’s performance was driven by strategic corporate moves and high-impact exploration:

- Strategic Funding: The company successfully closed an oversubscribed C$4 million financing in the September 2025 quarter. More significantly, Kincora announced it had unlocked over $100 million in potential partner funding through its project generator model, which significantly de-risks its exploration programs.

- High-Impact Drilling: The commencement of drilling at the Wongarbon Porphyry Project in Australia in November 2025, supported by a government grant, generated significant market excitement. While the project is outside Mongolia, its success validates the company’s geological expertise and management team, which is expected to translate to its Mongolian portfolio.

- Copper Exposure: The company’s focus on world-class porphyry targets provides strong leverage to the rising copper price environment, a key driver for investor interest in its low-market-cap structure (approximately C$37 million).

3: Erdene Resource Development Corp. (ERD.TO) - The Developer’s Payoff

Erdene Resource Development Corp. is a Canada-based mining company with more than 20 years of operating and exploration experience in Mongolia. The company focuses on the Khundii Gold District in southwest Mongolia and is advancing two high-grade, near-surface gold projects—Bayan Khundii Gold Mine and Dark Horse Gold Deposit—through a 50:50 joint venture with Mongolian Mining Corporation, held via Erdene Mongol LLC. Beyond its core gold assets, Erdene maintains district-scale exploration upside, including the Altan Nar gold deposit and the 100%-owned Zuun Mod molybdenum project, and is listed on the TSX and the Mongolian Stock Exchange.

The company delivered a strong +190% return, reflecting the market’s recognition of its successful transition from a pure developer to a gold producer. ERD remains focused on gold and copper exploration and development, with its flagship asset being the Bayan Khundii Gold Project (BKGP).

Performance Drivers: First Gold Pour and Strategic Growth

The single most important, verifiable catalyst for Erdene Resource Development Corporation over the past 12 months was the achievement of critical operational and strategic milestones that materially de-risked the business while expanding longer-term growth optionality:

- First Gold Pour: On September 14, 2025, Erdene announced the first gold pour at the Bayan Khundii Gold Mine in Mongolia. This milestone de-risked the project, confirmed operational readiness, and signaled the imminent start of cash flow, directly underpinning the stock’s appreciation.

- Production Ramp-up: In its Q3 2025 results (November 4, 2025), the Company confirmed expectations to reach nameplate production by year-end 2025, further solidifying its transition from developer to gold producer.

- Resource Expansion at Zuun Mod: In October 2025, Erdene announced an updated independent mineral resource estimate for its Zuun Mod molybdenum-copper porphyry project, confirming the asset as one of Asia’s largest undeveloped molybdenum-copper projects and materially strengthening the Company’s long-term copper and critical-minerals exposure.

- Exploration Upside and District Scale Growth: In early July 2025, Erdene executed an option agreement to acquire up to an 80% interest in a property adjacent to Oyu Tolgoi, one of the world’s largest copper-gold deposits. In parallel, drilling commenced at Zuun Mod, while surface exploration programs continued at the Tereg Uul copper-gold porphyry prospect, adding multiple exploration-driven growth vectors beyond Bayan Khundii.

2025 has been a year of execution for Mongolia-linked mining companies. The top performers have delivered clear value creation through operational success (STGO), project commissioning (ERD), and strategic exploration funding (KCC). These tangible achievements continue to reinforce Mongolia’s credibility and appeal as a mining investment destination.

Looking ahead, the focus shifts from hitting milestones to scaling. For STGO, attention is on sustaining high-margin production while advancing ATO Phase 2, translating stable output into stronger cash flow amid supportive gold prices. ERD is concentrating on achieving and maintaining nameplate production at the Bayan Khundii Gold Project, a key step toward consistent, recurring cash flow and validating its transition into a producer. Meanwhile, KCC enters its next catalyst phase, with initial drilling results expected from the Wongarbon project. Combined with partner-funded capital, this is expected to advance its Mongolian exploration portfolio while maintaining balance-sheet flexibility.

For those interested in exploring these companies and their projects, or seeking other investment opportunities in the mining sector, the CMM advisory team is ready to provide expert insights and guidance.

Loading ...

.jpg)