Is the Age of Strategic Capital Finally Here?

Feb 10, 2026

Tselmeg E.

For decades, the path for Mongolian business growth followed a singular, well-worn trail: the traditional bank loan. For a long time, banks weren’t just the primary option—they were the foundational pillar of the economy. However, as the Mongolian economy matures, so too are the ways businesses choose to fund their future.

In 2025, the data suggests we are witnessing a structural evolution. The center of gravity in Mongolian corporate finance is expanding, shifting from a bank-centric model toward a more dynamic, multi-layered capital market.

From Dependency to Diversity

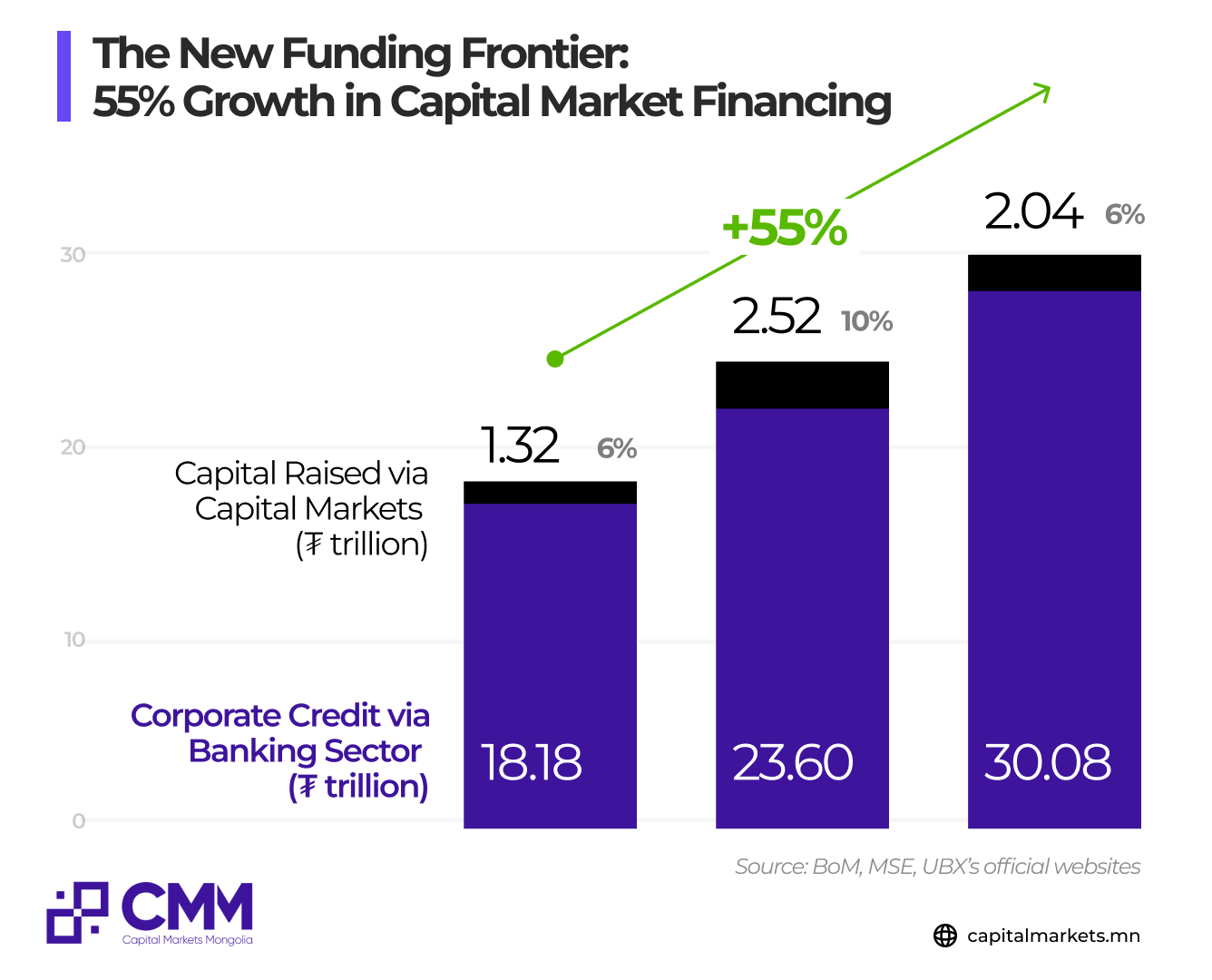

Historically, Mongolia’s corporate financing was heavily weighted toward the banking sector. As of 2023, approximately 97.5% of non-financial corporate funding originated from bank loans, with capital markets representing only a 2.5% share.

While banks provided the essential liquidity that built modern Mongolia, this high level of concentration created a "growth ceiling" for companies requiring more bespoke financial structures.

The Breakout Years: 2023–2025

Then something changed. Between 2023 and 2025, capital raised through Mongolia’s capital markets jumped by more than 55%. What was once a marginal channel has started to become a real alternative.

The real explosion, however, did not come from only IPOs. It came mainly from corporate bonds.

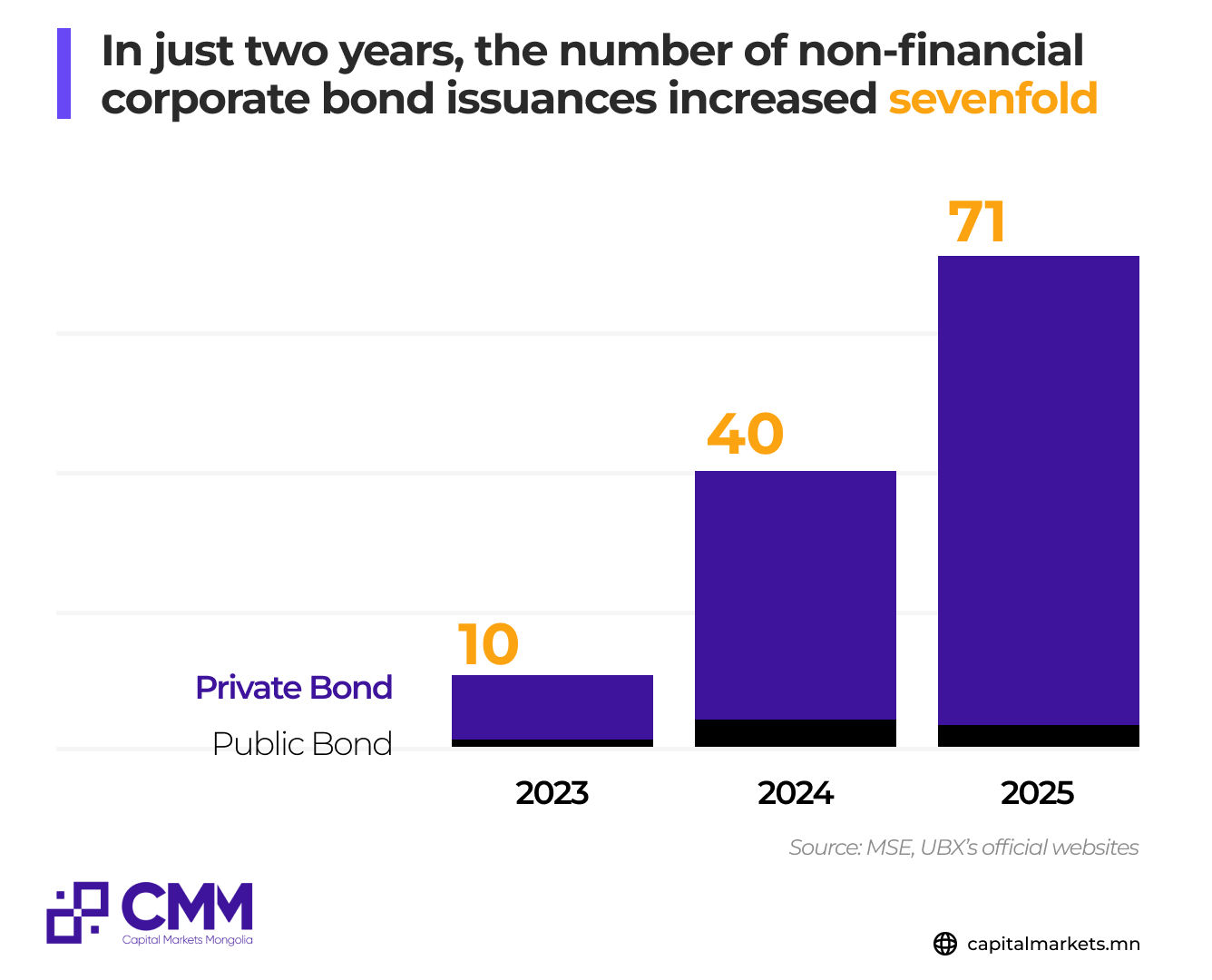

In just two years, the number of non-financial corporate bond issuances increased sevenfold. This marks the fastest structural shift in Mongolia’s financial history — a transition from relationship-based lending to market-based financing.

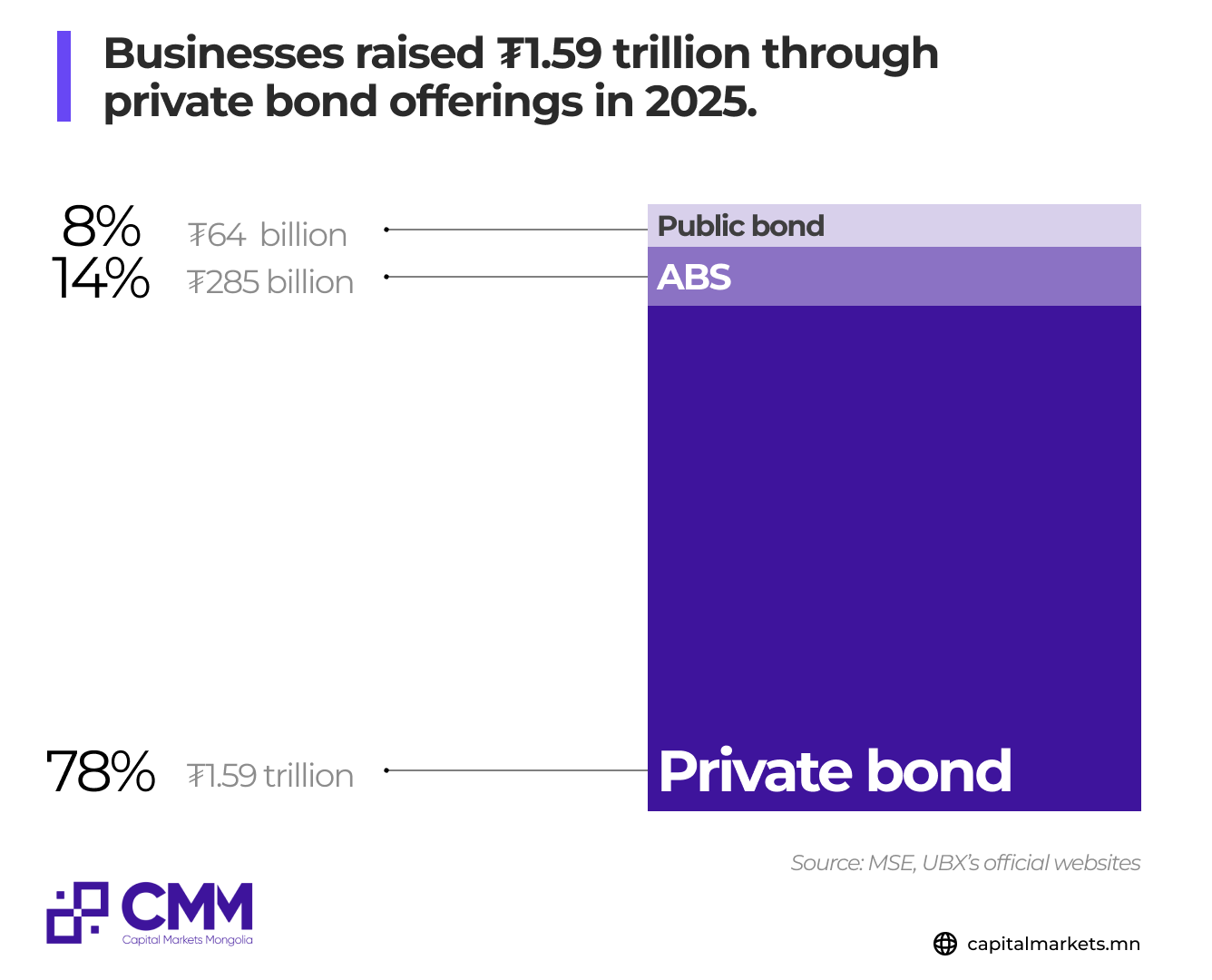

Even more striking is where this activity is happening: the M-OTC market. In 2025 alone, private bond placements in the M-OTC market reached ₮11.59 trillion — a figure that would have been unthinkable just five years ago.

Why Companies are Integrating Capital Markets into their Growth Strategy

Mongolian businesses are no longer looking for a "one-size-fits-all" solution; instead, they are using capital markets to complement traditional bank credit. Here is why the market-based approach is gaining momentum:

- Customized Financial Architecture: While bank loans are often standardized, bonds allow companies to "engineer" their debt. This means tailoring repayment schedules to match specific project-based cash flows, seasonal revenue peaks, or long-term infrastructure lifecycles.

- Agility and Execution Speed: In a high-growth economy, opportunity windows close quickly. The M-OTC platform allows seasoned companies to raise capital in a fraction of the time required for traditional credit reviews, turning speed into a competitive asset.

- Portfolio Synergy: As the banking sector moves toward international standards and selective "green" or priority lending, capital markets provide a vital secondary lung for the economy. Businesses are finding that having a mix of bank debt and corporate bonds creates a more resilient balance sheet.

- Building a Public Track Record: Issuing a bond is often a strategic stepping stone. It allows a company to build a credit history with a broad base of investors, enhancing their reputation and preparing them for future international expansion or public listing.

The Future of Mongolian Finance: Beyond the Bank

The rise of the capital market does not signify a replacement of the banking sector; rather, it marks the birth of a more mature and resilient financial ecosystem. We are moving toward a landscape where bank credit and market-based financing work in tandem to support the national economy.

For the modern Mongolian CEO, the question is no longer just "How much can I borrow?" but "What is the most strategic way to fund this growth?" This evolution brings Mongolia closer to global financial standards, creating a more stable, transparent, and flexible environment for investment.

The era of the single-channel economy is transitioning into an era of strategic capital synergy, where the right combination of tools is unlocking the next chapter of Mongolian ambition.

Loading ...